So, you’re looking to buy a home in Malaysia? That’s exciting! But before you can start packing up your belongings and deciding how to decorate your new space, there’s one crucial step you need to navigate: the home loan process. Now, the mere mention of this can send shivers down some people’s spines, but fear not! In this article, we’re going to demystify the home loan process in Malaysia, taking you from application to approval step by step. By the end, you’ll have a clear understanding of what to expect and how to navigate this sometimes complex journey with confidence. So, let’s get started and turn that dream of homeownership into a reality!

Understanding the Home Loan Process

What is a home loan?

A home loan, also known as a mortgage, is a type of loan provided by financial institutions to help individuals purchase a property. It is a long-term loan that is secured by the property being purchased, which means that if the borrower fails to repay the loan, the lender has the right to take ownership of the property.

Why do people get a home loan?

People get a home loan because it allows them to purchase a property without having to pay the full purchase price upfront. Instead, they can make a down payment and borrow the remaining amount from a lender. This makes buying a home more affordable and accessible for many individuals and families.

Key terms and concepts to know

Before diving into the home loan process, it’s important to familiarize yourself with some key terms and concepts.

- Principal: The amount of money you borrow from the lender.

- Interest: The cost of borrowing money, usually expressed as a percentage of the loan amount.

- Down payment: The initial payment made by the borrower at the time of purchase, often a percentage of the total property value.

- Amortization: The process of gradually paying off the loan over a specified period of time through regular installments.

- Loan term: The length of time it will take to fully repay the loan, typically ranging from 15 to 30 years.

Understanding these terms will help you navigate the home loan process more effectively.

Types of home loans available

There are several types of home loans available, each with its own features and benefits. Here are some of the most common types:

- Conventional loans: These are traditional home loans that are not guaranteed or insured by any government agency.

- FHA loans: Insured by the Federal Housing Administration, these loans are designed to make homeownership more accessible for borrowers with lower credit scores or limited down payment funds.

- VA loans: Available to eligible veterans and their spouses, these loans are guaranteed by the Department of Veterans Affairs and often offer favorable terms and lower interest rates.

- USDA loans: These loans are offered by the U.S. Department of Agriculture and are designed to help individuals in rural areas purchase a home.

It’s important to explore your options and choose the type of home loan that best fits your needs and financial situation.

Preparing to Apply for a Home Loan

Determining your budget

Before applying for a home loan, it’s crucial to determine your budget and how much you can afford to borrow. Consider your income, existing debts, and monthly expenses to calculate a realistic monthly mortgage payment. This will help you avoid taking on more debt than you can comfortably handle.

Checking your credit score

Your credit score plays a significant role in determining your eligibility for a home loan and the interest rate you’ll be offered. Before applying, check your credit score and review your credit report for any errors or discrepancies. If your score is lower than desired, take steps to improve it, such as paying off outstanding debts and making payments on time.

Gathering necessary documents

When applying for a home loan, you’ll need to provide various documents to support your application. These typically include:

- Proof of identity (e.g., passport, driver’s license)

- Proof of income (e.g., pay stubs, tax returns)

- Bank statements

- Employment verification

- Proof of assets (e.g., savings accounts, investment portfolios)

- Proof of down payment funds

Gathering these documents in advance will help streamline the application process and make it easier for the lender to assess your eligibility.

Researching and comparing lenders

Not all lenders are the same, so it’s important to research and compare your options before choosing a lender. Consider factors such as interest rates, loan terms, customer reviews, and the lender’s reputation. Request loan estimates from multiple lenders to compare costs and determine the best fit for your needs.

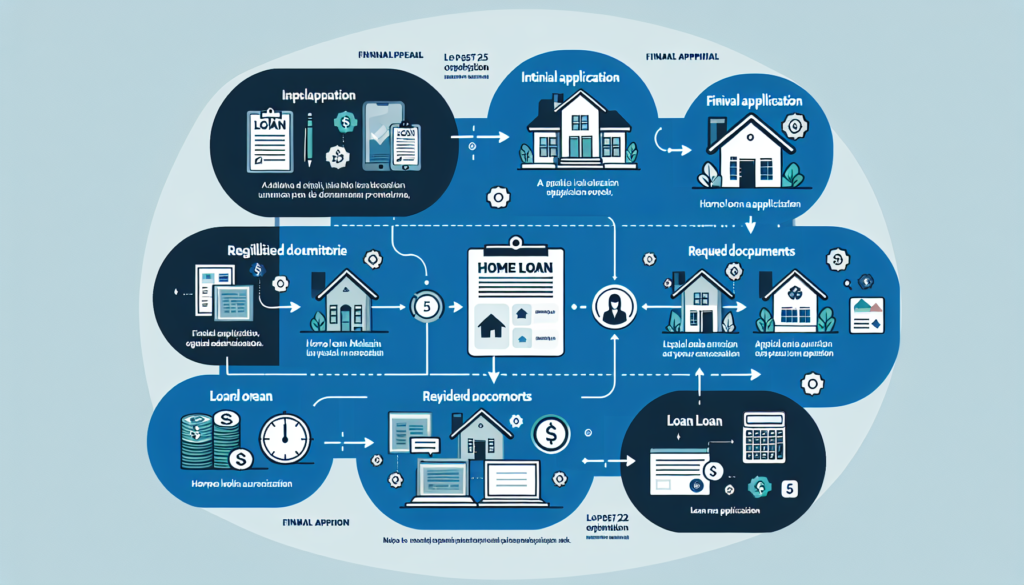

The Loan Application Process

Completing the application form

Once you’ve gathered all the necessary documents and selected a lender, it’s time to complete the loan application form. This form will ask for personal and financial information, such as employment history, income details, and details about the property you wish to purchase.

Submitting required documents

After completing the application form, you’ll need to submit the required documents to support your application. Ensure that all documents are accurate, up-to-date, and legible. Submitting incomplete or incorrect documents can delay the loan approval process.

Providing additional information

During the application process, the lender may request additional information or clarification on certain aspects of your application. It’s important to respond promptly and provide any requested information to help move the process along smoothly.

Paying any applicable fees

Some lenders may charge fees during the loan application process, such as an application fee or an appraisal fee. It’s important to review and understand all fee structures before proceeding with the application. Be prepared to pay these fees as required by the lender.

The Home Loan Approval Process

Assessment by the lender

Once your application and supporting documents have been submitted, the lender will assess your eligibility and determine whether to approve your loan. They will review factors such as your credit score, income stability, debt-to-income ratio, and the property you wish to purchase.

Property valuation

As part of the home loan approval process, the lender will typically require a property valuation to ensure that the property’s value aligns with the loan amount. This helps protect the lender’s investment and ensures that the property serves as adequate collateral.

Loan approval criteria

Lenders have specific criteria for approving home loans, such as minimum credit scores, debt-to-income ratios, and down payment requirements. It’s important to understand these criteria and work towards meeting them to increase your chances of loan approval.

Conditional approval

In some cases, the lender may provide conditional approval for your home loan. This means that while your application has been approved in principle, certain conditions must be met before final approval and disbursement of funds. These conditions may include providing additional documents or completing certain tasks.

Understanding Loan Repayment

Loan repayment options

When it comes to repaying your home loan, you typically have two options: a fixed-rate mortgage or an adjustable-rate mortgage (ARM). With a fixed-rate mortgage, your interest rate remains the same throughout the loan term, providing predictability. With an ARM, the interest rate is subject to change periodically, often resulting in fluctuating monthly payments.

Interest rates and monthly installments

The interest rate on your home loan will have a significant impact on your monthly installments. A higher interest rate means higher monthly payments, while a lower interest rate means lower payments. It’s important to understand the terms of your loan and how the interest rate will affect your repayment.

Grace periods and penalties

Some home loans may offer a grace period, which allows borrowers a temporary delay in making their first payment after the loan is disbursed. However, it’s important to note that late or missed payments can result in penalties and may negatively impact your credit score. Be sure to understand the grace period and payment schedule associated with your loan.

Managing Your Home Loan

Setting up automatic repayments

To avoid missing payments and incurring penalties, consider setting up automatic repayments for your home loan. This ensures that your monthly installment is deducted from your bank account on time, simplifying the repayment process and reducing the risk of late or missed payments.

Monitoring interest rates

Even after you’ve secured a home loan, it’s important to stay informed about interest rates. If interest rates decrease significantly, refinancing your loan may be a viable option to lower your monthly payments. Keep an eye on market trends and consult with your lender to determine if refinancing is a good choice for you.

Refinancing options

Refinancing your home loan involves taking out a new loan to pay off your existing loan. This can be beneficial if you can secure a lower interest rate or more favorable loan terms. However, it’s important to evaluate the costs associated with refinancing, such as closing costs and fees, to ensure that the benefits outweigh the expenses.

Seeking professional advice

Managing a home loan can be complex, so it’s advisable to seek professional advice when needed. A financial advisor or mortgage specialist can provide guidance on loan repayment strategies, refinancing options, and other aspects of managing your home loan. They can help you make informed decisions and navigate any challenges that may arise.

Common Challenges and Pitfalls

Inadequate preparation

One common challenge in the home loan process is inadequate preparation. Failing to gather all necessary documents, not fully understanding the loan terms, or underestimating the financial commitment can lead to delays and potential issues during the application and approval process. Take the time to properly educate yourself and prepare before embarking on the home loan journey.

Discrepancies in documents

Discrepancies or errors in the documents submitted during the loan application process can cause delays and raise red flags for lenders. Ensure that all documents are accurate, consistent, and up-to-date. Double-check the information provided to avoid unnecessary complications.

Property valuation issues

If the property you wish to purchase is not valued at the expected amount or does not meet the lender’s requirements, it can create challenges in the loan approval process. Conduct thorough research and work with reputable appraisers to ensure that the property’s value aligns with your expectations and the lender’s criteria.

Credit issues

Poor credit history, low credit scores, or excessive debt can pose challenges in obtaining a home loan. It’s important to address any credit issues before applying for a loan. Take steps to improve your credit score, pay off outstanding debts, and demonstrate responsible financial behavior to increase your chances of loan approval.

Tips for a Smooth Home Loan Process

Start early and plan ahead

The home loan process can be time-consuming, so it’s crucial to start early and plan ahead. Allow yourself ample time to gather documents, research lenders, and navigate the application process. Starting early also gives you more time to address any issues that may arise along the way.

Maintain a good credit score

A good credit score is instrumental in securing a favorable home loan. Prioritize maintaining a good credit score by paying bills on time, keeping debt levels manageable, and monitoring your credit report for any errors or discrepancies. A higher credit score not only increases your chances of loan approval but also allows you to qualify for better interest rates.

Be meticulous in document preparation

The accuracy and completeness of your loan application and supporting documents are crucial. Be meticulous in preparing and reviewing all required documents, ensuring that they are properly filled out, signed, and dated. This attention to detail can save you time and prevent unnecessary delays in the loan approval process.

Choose a reliable lender

Selecting a reliable lender is essential for a smooth home loan process. Research and compare lenders, read customer reviews, and consider recommendations from trusted sources. Look for a lender with a solid reputation, competitive interest rates, and excellent customer service. A reliable lender will guide you through the loan process and provide the necessary support and assistance.

Frequently Asked Questions

What is the minimum credit score required?

The minimum credit score required for a home loan varies depending on the lender and the type of loan. Conventional loans generally require a credit score of around 620 or higher, while government-backed loans like FHA and VA loans may have lower minimum credit score requirements. It’s best to consult with individual lenders to determine their specific credit score requirements.

Can foreigners apply for a home loan in Malaysia?

Yes, foreigners can apply for a home loan in Malaysia. However, there may be certain restrictions and requirements imposed by the Malaysian government and lenders. Foreigners typically need to meet specific eligibility criteria, such as having a valid work permit or a certain minimum income threshold. Consulting with lenders who specialize in loans for foreigners can help navigate the application process.

What documents are required for self-employed individuals?

Self-employed individuals typically need to provide additional documentation compared to those who are employed by a company. Besides the standard documents required for all loan applications, self-employed individuals may be asked to provide business financial statements, proof of business ownership, and tax returns for the past few years. These additional documents help lenders assess the stability and profitability of the self-employed individual’s business.

How long does the approval process usually take?

The approval process for a home loan can vary depending on various factors such as the lender’s internal processes, the complexity of the loan application, and the availability of all required documents. On average, the process can take anywhere from a few weeks to a few months. To expedite the process, it’s important to ensure that all required documents are provided promptly and respond promptly to any requests for additional information.